how to file taxes for coinbase

Use the Coinbase tax report API with crypto tax software. Select the relevant cryptocurrency.

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

It will be deposited into your Coinbase account in US.

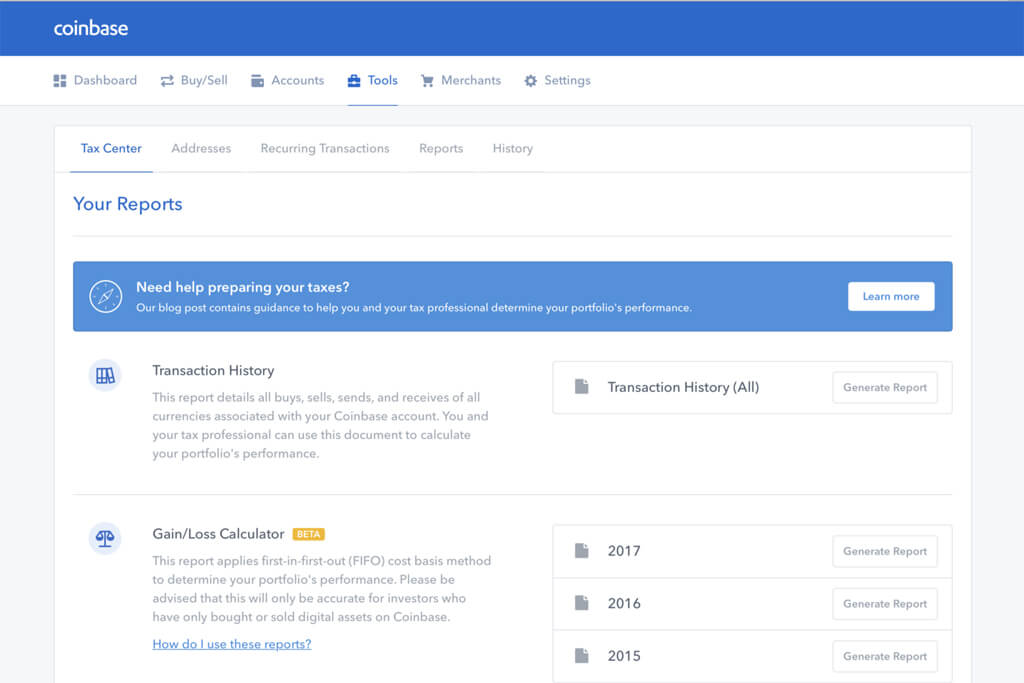

. You can generate your gains losses and income tax reports from your Coinbase investing activity by connecting your account with CoinLedger. To add your Coinbase Wallet account to Coinpanda follow these steps. The most common reason people need to report crypto on their taxes is that theyve sold some assets at a gain or loss similar to buying and selling stocks so if you buy one.

Thank you for contacting us for assistance with your concern. If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received. If you choose to take advantage of this offer youll need to.

From there you can choose if when and how you want to invest. This is income paid to you by Coinbase so. You dont have to file a Coinbase tax.

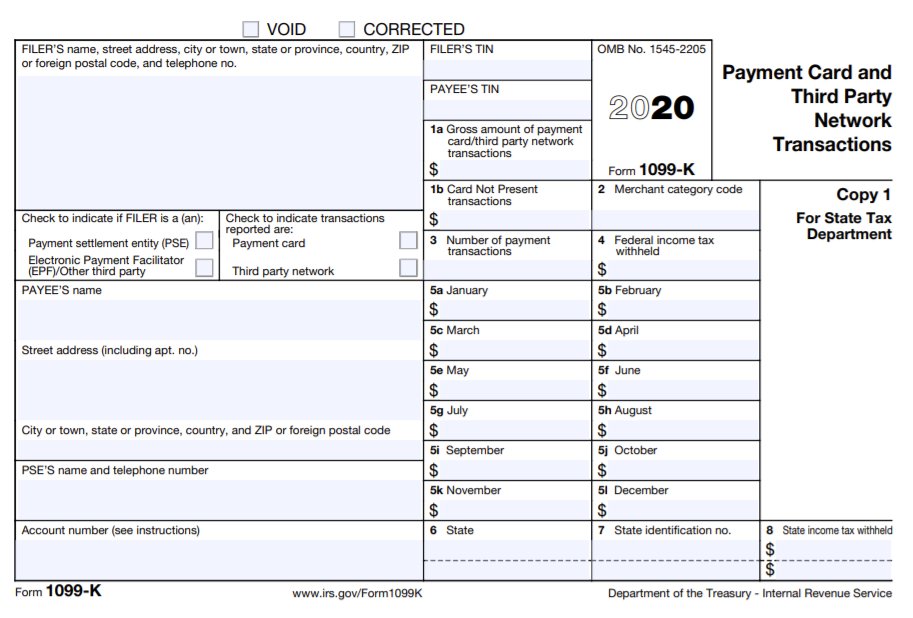

Paste your xPub address or public address. Within CoinLedger click the Add Account button on the top left. Similar to the 1099-K.

Crypto can be taxed in two ways. Either as income a federal tax on the money you earned or as a capital gain a federal tax on the profits you made from selling certain assets. Coinbase wont and cant provide all of the necessary information required to file taxes.

How to File Crypto Taxes with Coinbase How to Do Crypto TaxesHow to Pay Crypto Taxes in the USDoes Crypto Get TaxedHow Crypto Taxes Work on Coinbase FULL G. Similar to stock you only pay taxes on capital gains once you sell. The only form they still issue is 1099-MISC probably to streamline their tax services.

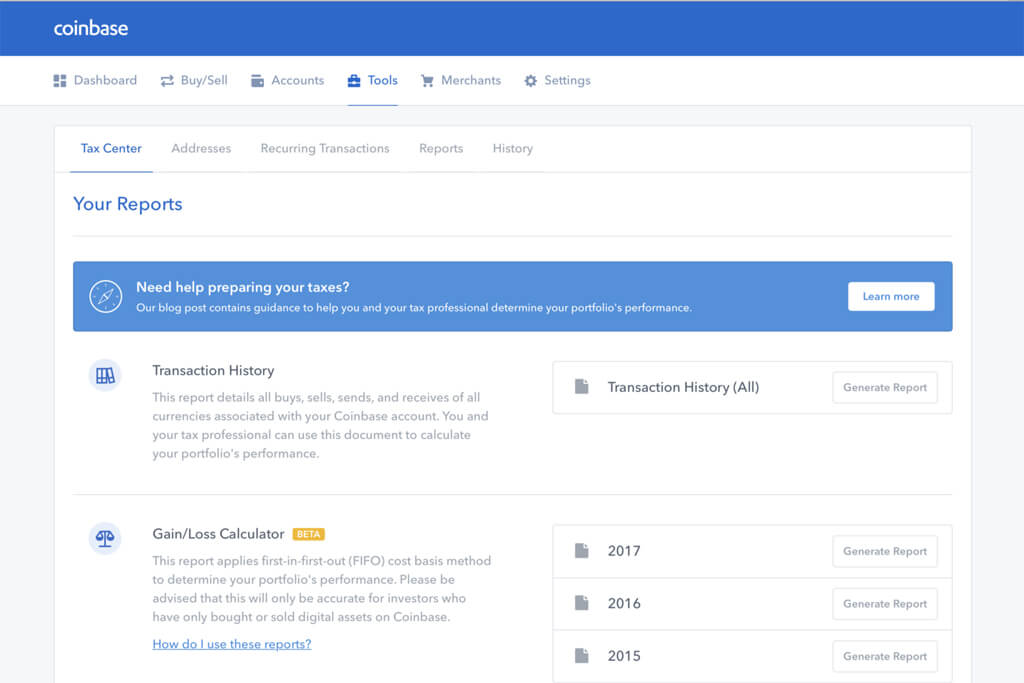

The crypto exchange company said in a blog post that a new section in its app and website. Coinbase no longer issues 1099-K or 1099-B for its traders as of the 2020 season. Coinbase Tax Reporting.

Dollars so you will have full access to your tax refund. Find Coinbase Pro in the list of supported exchanges and select the import method you prefer. Coinbase Pro features advanced charting features and a huge range of crypto trading pairs - making it an ideal exchange for more experienced crypto traders.

Late response but you dont need to pay taxes on bitcoins while theyre in coinbase because you havent realized the gains. Upload a CSV file to. TIN and legal name used by.

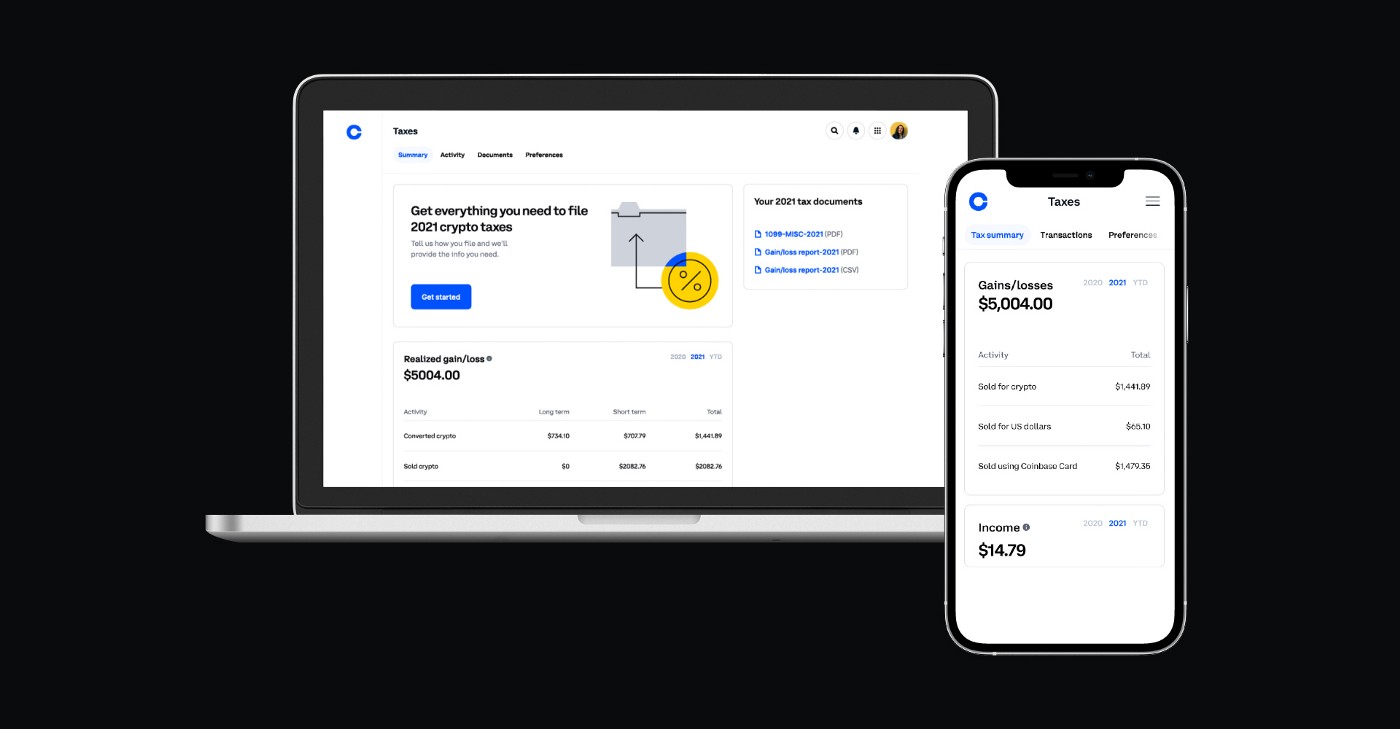

Coinbase Taxes will help you understand. Youve earned 600 or more in miscellaneous income such as rewards or fees from Learning rewards USDC Rewards andor staking in 2021. Im Victor and I will be happy to assist you with your question.

If you use the Coinbase tax reporting API with a crypto tax app - all your Coinbase transaction history will be. Coinbase wants to help customers file cryptocurrency taxes for the 2021 tax year.

Your Crypto Tax Guide Turbotax Tax Tips Videos

Tweets Dont Tax Advice On Twitter Fintaxdude Coinbase This Is Funny We Are Not Required To Issue A Form 1099 B Or Issue Reporting To The Irs If You Sell Trade

![]()

Coinbase Makes It Easier To Report Cryptocurrency Taxes The Verge

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

New Crypto Tax Reporting Requirements In The 2021 Infrastructure Bill

Shehan On Twitter Breaking 1 Next Year Coinbase Is Planning To Issue A New Crypto Tax Form 1099 Misc And Abandon The Old Form 1099 K Which Created A Tax Nightmare For Many Taxpayers

Does Coinbase Report To Irs All You Need To Know

How To File Crypto Taxes With Turbotax In 3 Steps Ledgible Crypto

Shehan On Twitter Breaking 1 Next Year Coinbase Is Planning To Issue A New Crypto Tax Form 1099 Misc And Abandon The Old Form 1099 K Which Created A Tax Nightmare For Many Taxpayers

New Resources For Crypto Taxes Disclaimer Coinbase Is Not Authorized By Coinbase The Coinbase Blog

Crypto Tax How To Report Your Virtual Currency Bitcoin Ethereum Coinbase Etc The Official Blog Of Taxslayer

Coinbase Is Now Your Personalized Guide To Crypto Taxes Coinbase

File Taxes With Turbotax And Get Tax Refund Into Coinbase Account

Coinbase Tax Documents To File Your Coinbase Taxes Zenledger

Coinbase Customer S Lawsuit Against Irs Reminds Taxpayers Of Government S Interest In Auditing Virtual Currency Traders

Coinbase Issues 1099s Reminds Users To Pay Taxes On Bitcoin Gains

Coinbase Launches Cryptocurrency Tax Calculator For U S Customers Coinspeaker